Scaling Buy Now, Pay Later

As a leading Buy Now, Pay Later (BNPL) platform, Addi empowers over 2 million clients to access instant loans at the checkout of 20K top e-commerce sites and physical stores across Latin America.

Date

March 2021

Company

Addi

Team

PMs and EMs

Role

Product Designer

Platform

Web, Responsive

The problem

The pandemic-driven surge in e-commerce forced Addi to pivot its product from a salesperson-assisted model in physical stores to a fully self-service solution directly integrated into the allies e-commerce checkouts.

Discovery

Define

Job to be done

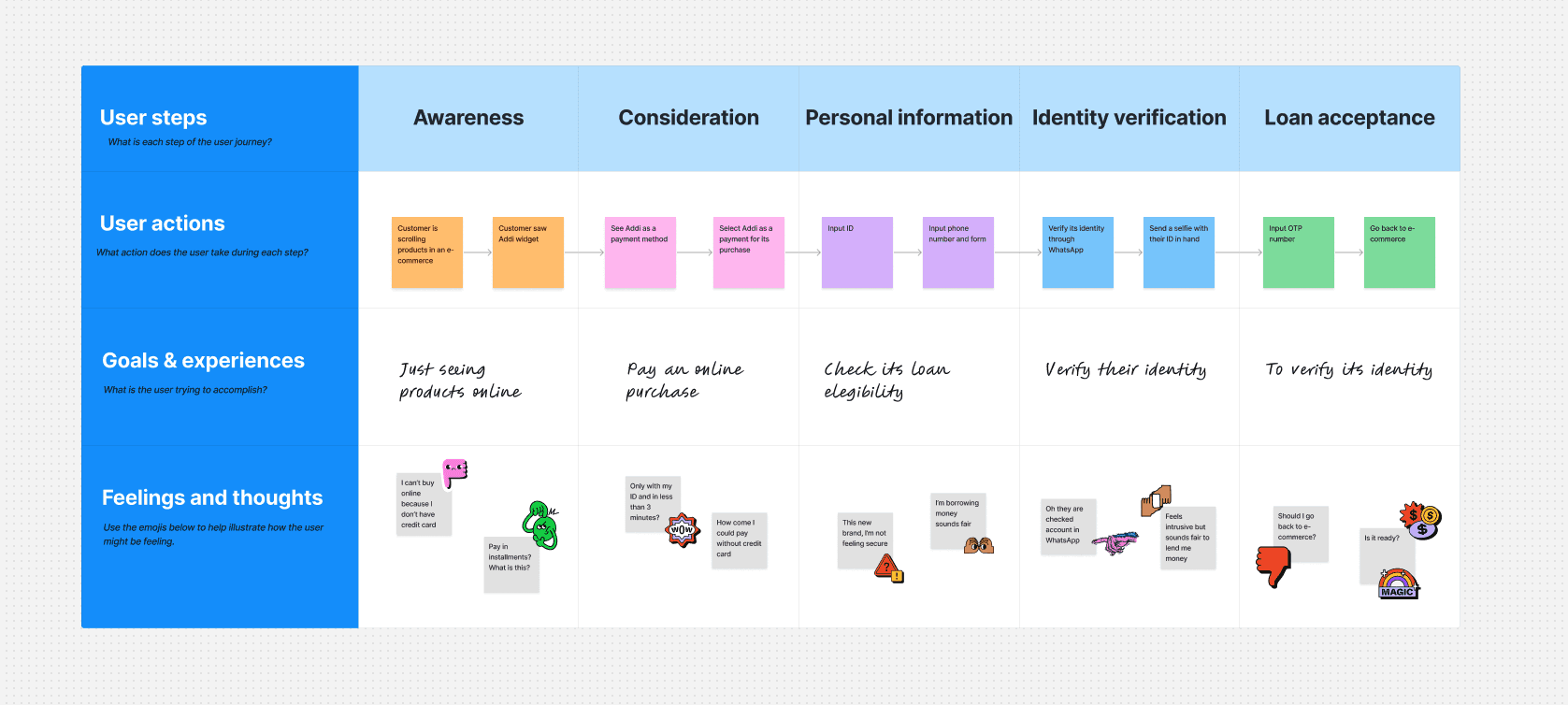

End customers turn to Addi for online purchases when traditional banks won’t extend credit, using our platform not only for products but also for essential services like education and streaming.

Business outcomes

Conversion rates on our partners’ shopping carts became our primary metric for tracking success, allowing us to effectively measure our loan disbursement impact on end customers.

Ally needs

Simply displaying Addi as a payment option at checkout wasn’t enough to create real value for our partners. We needed to become a key driver in the e-commerce customer journey, influencing purchase decisions and motivating conversions.

Decision bias

Customers’ limited financial literacy meant they weren’t focused on installment plans or fees; with 50% of loans repaid in under a month, asking about these details only disrupted the user experience decreasing conversion rates.

Develop

Safety

Lending process required customers to share sensitive information, which raised concerns given Addi’s newness in the market. Robust authentication and authorization mechanisms became essential to establish trust and ensure data security.

Integrated

We mapped a journey that begins at the moment of purchase intent directly in the product pages delivering value to Addi’s partners not just at checkout but by attracting customers at the top of the funnel.

Frictionless

Streamlining the online borrowing process brings our value proposition to life for partners, striking a balance between ease of use and the necessary steps to verify customer identity and authorize payments.

Familiarity

We request specific customer data at key points in the journey, we ensure they feel comfortable sharing this information by integrating seamlessly with the platforms they already use in their daily lives.

Delivery highlights

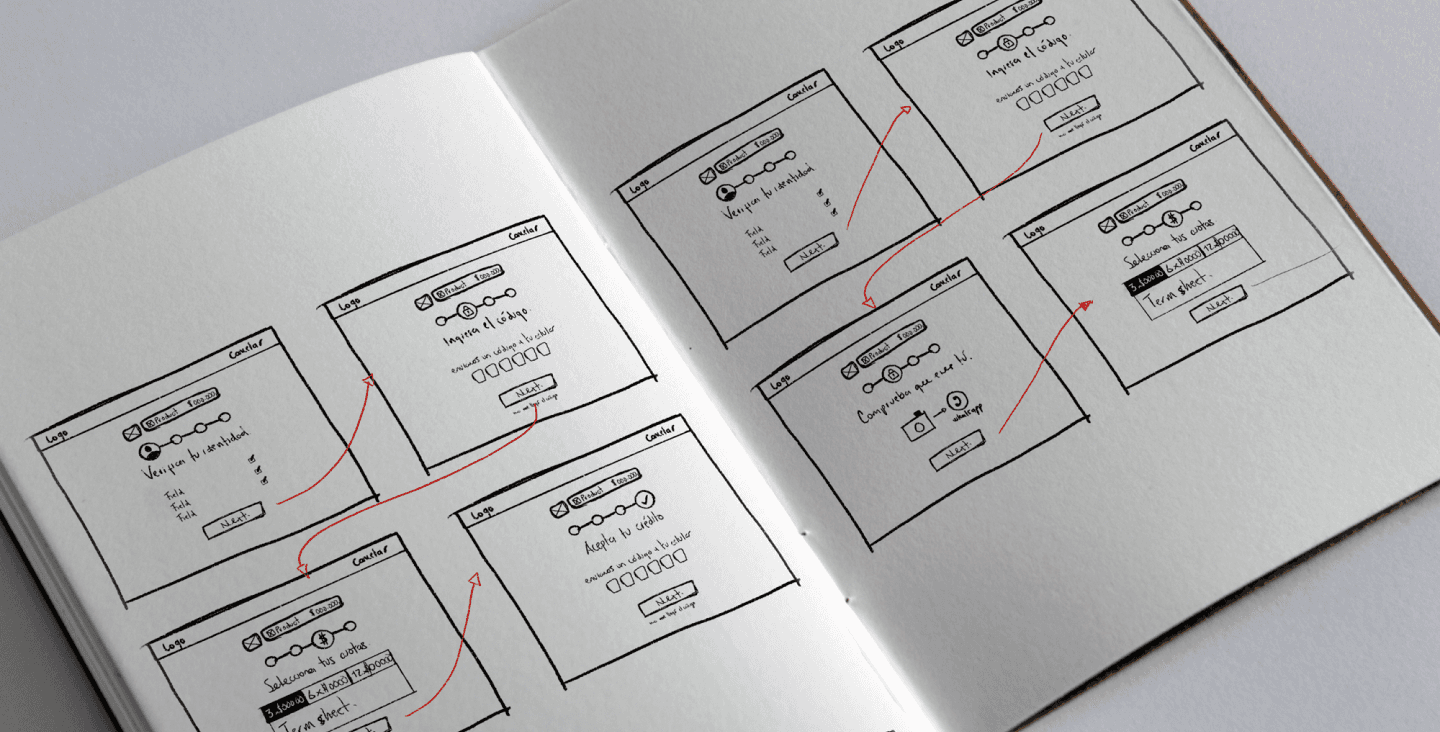

After ideating, gathering insights, and documenting the entire process, we designed a customer journey implemented through an iterative approach. Each funnel step was monitored post-launch to track conversions, allowing us to optimize each stage based on conclusive data and continually enhance performance.

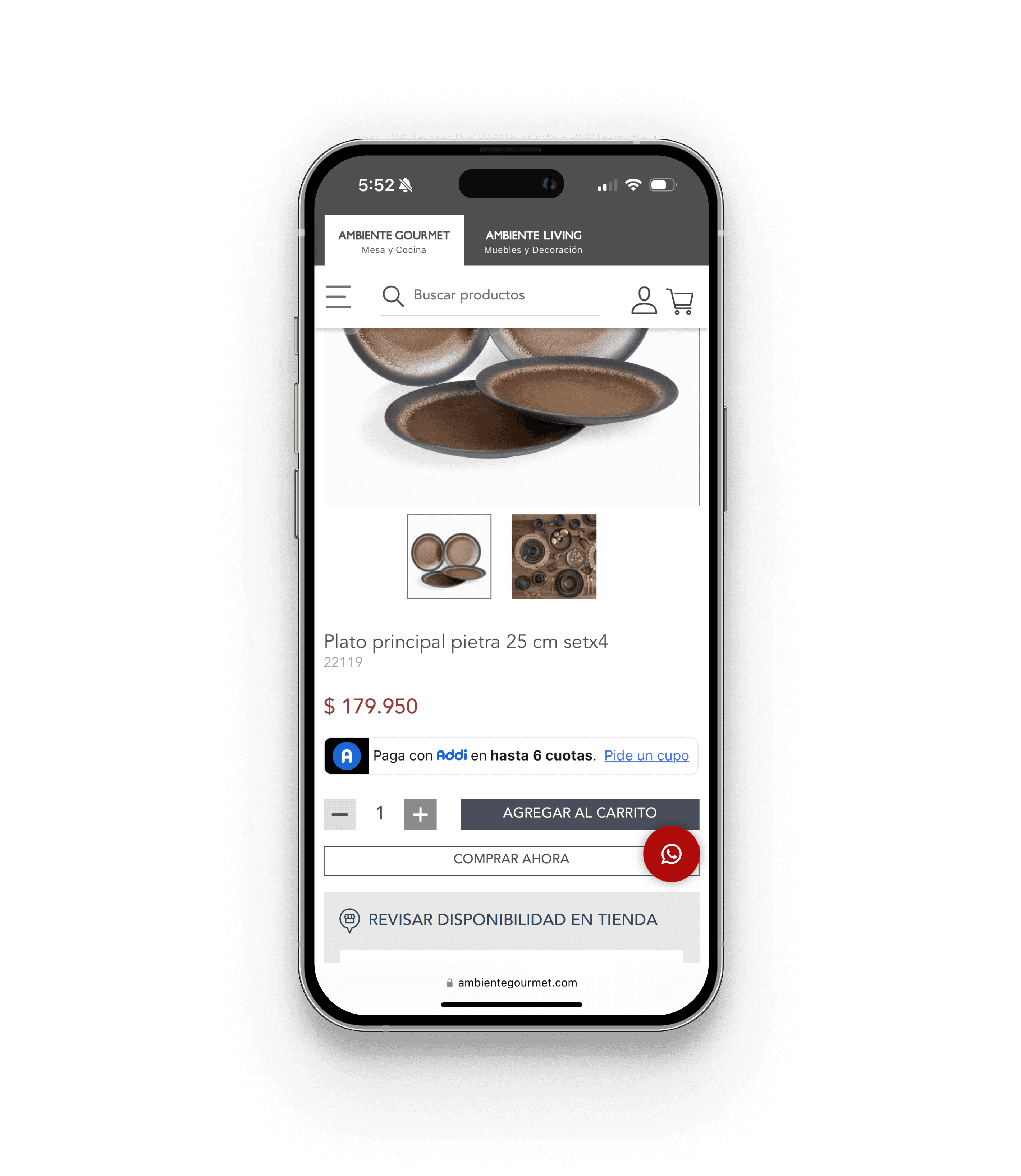

Product page

Before the product journey even begins, we developed an easily deployable widget for partners to integrate directly on product pages. This ensures that all potential customers are aware of the option to pay in installments, bringing loan prospects into the top of the funnel and positioning Addi as not just a payment method, but a compelling reason to buy.

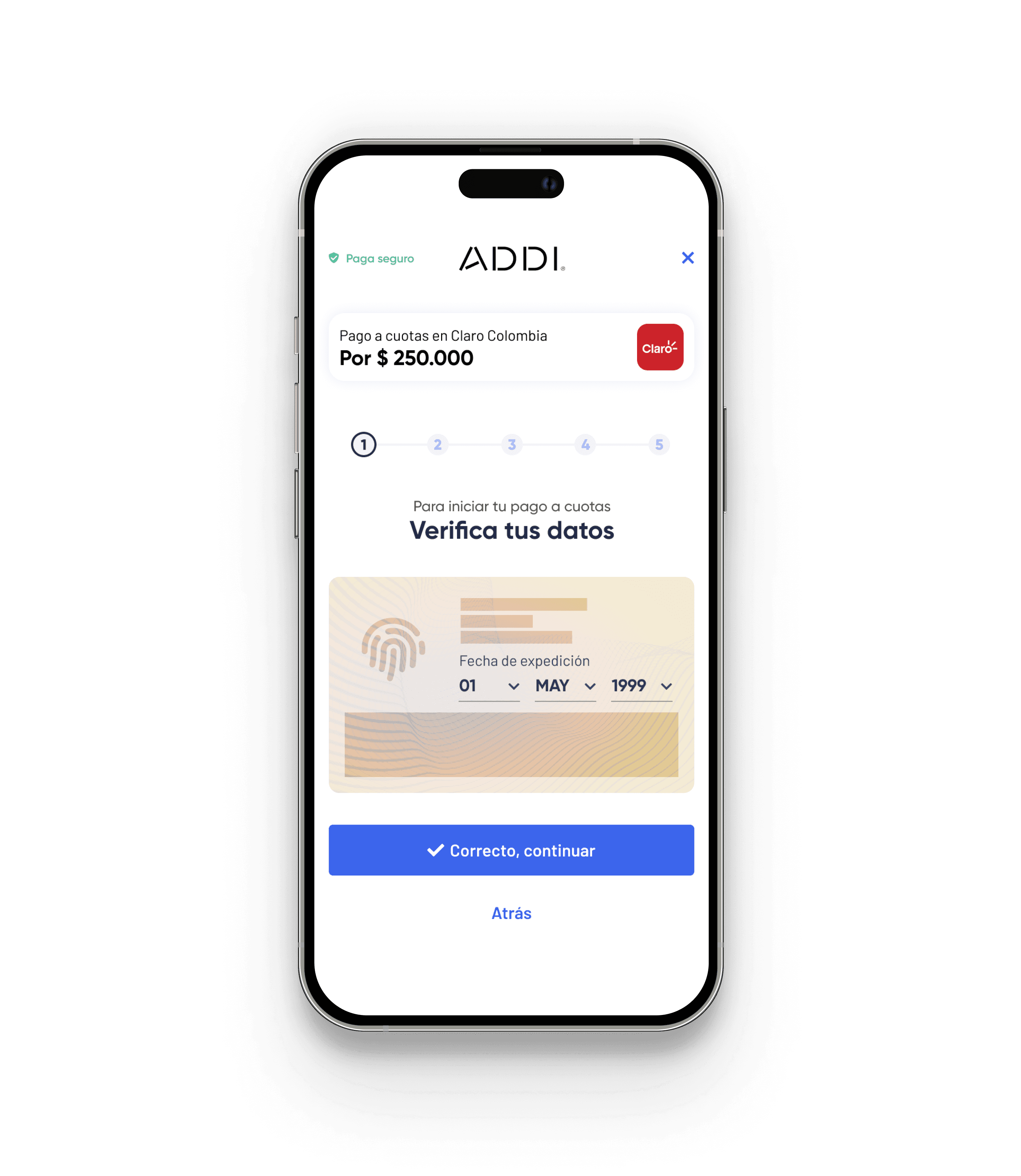

Personal information

Our first step in building customer trust involves requesting personal information to assess loan eligibility. We localized the UI to create a familiar, intuitive experience, helping customers navigate the process with ease and enhancing their confidence in our platform.

Loan proposal

This step in the journey presented a unique challenge. Initially, we assumed customers would want to select their preferred number of installments, but the data told a different story: 85% of customers opted for the maximum number of installments to minimize their monthly payments.

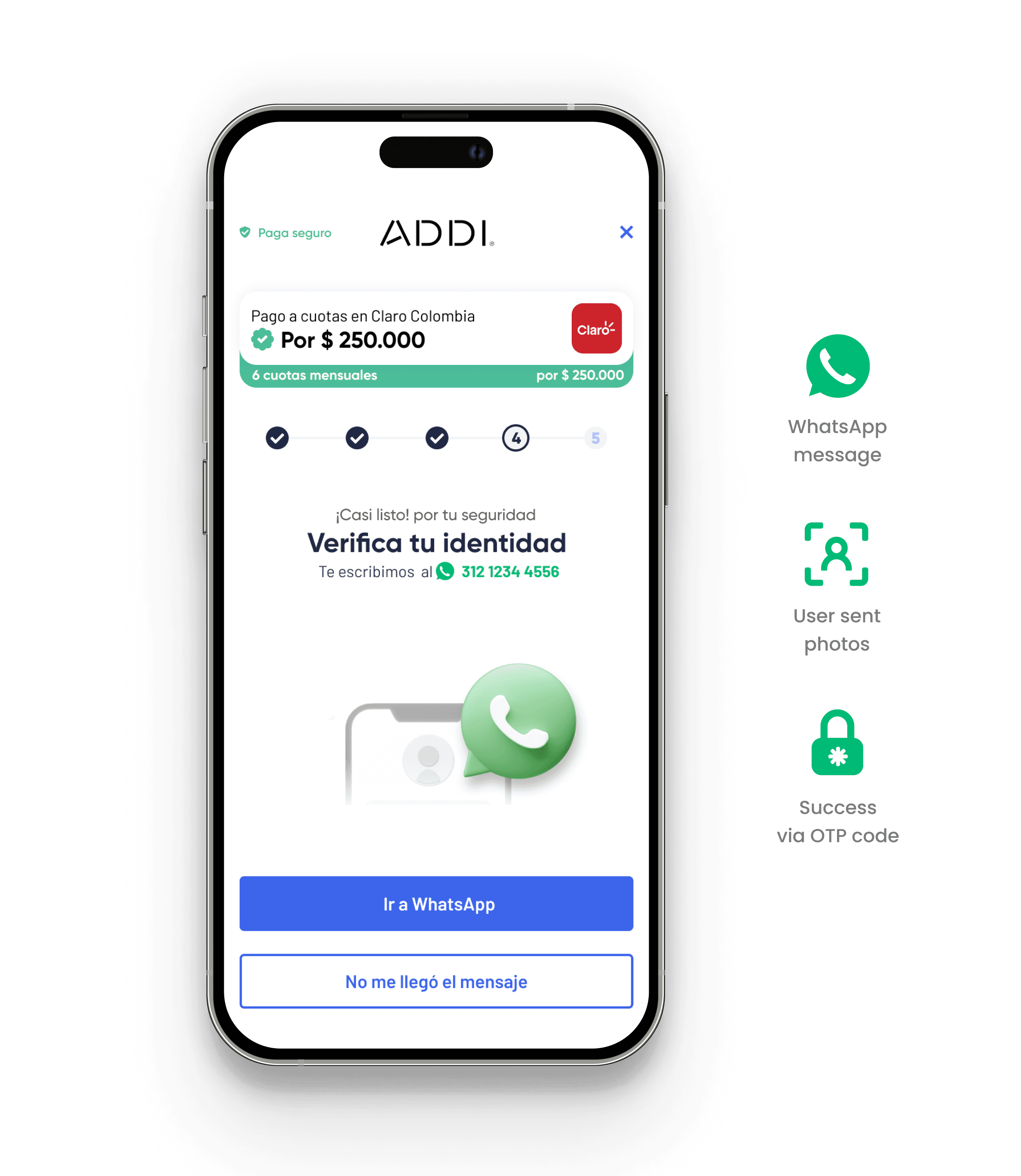

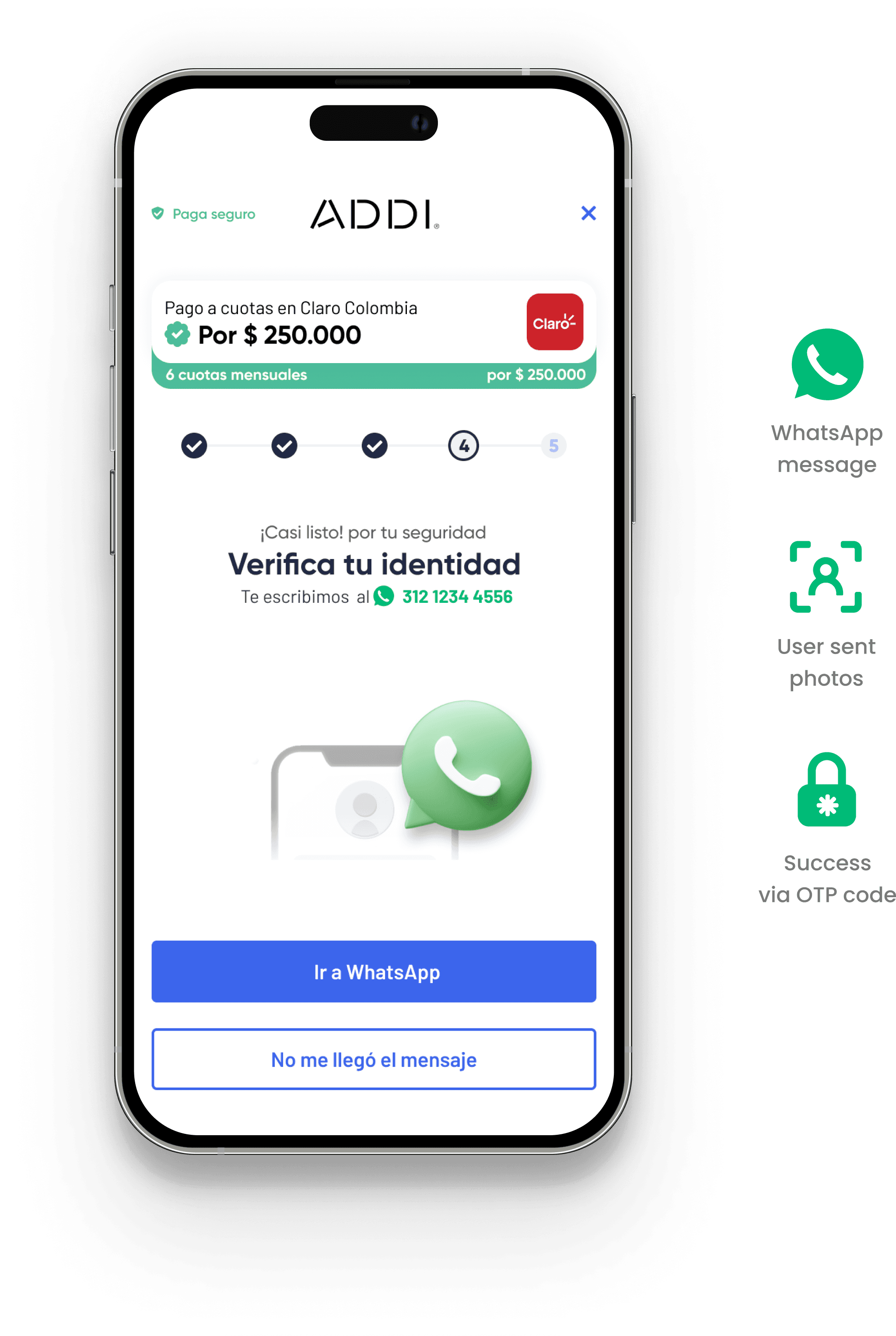

Identity verification

To verify identity securely and protect customer data from fraud, we required photos of both the customer’s ID and a live selfie. Initially, we launched with third-party, browser-based technology, which limited our control over the user experience. Post-launch, we discovered that customers were already accustomed to sharing photos via WhatsApp, so we transitioned to an in-house KYC bot. This not only streamlined the verification process but also allowed us to deliver world-class customer support directly within the familiar messaging platform.

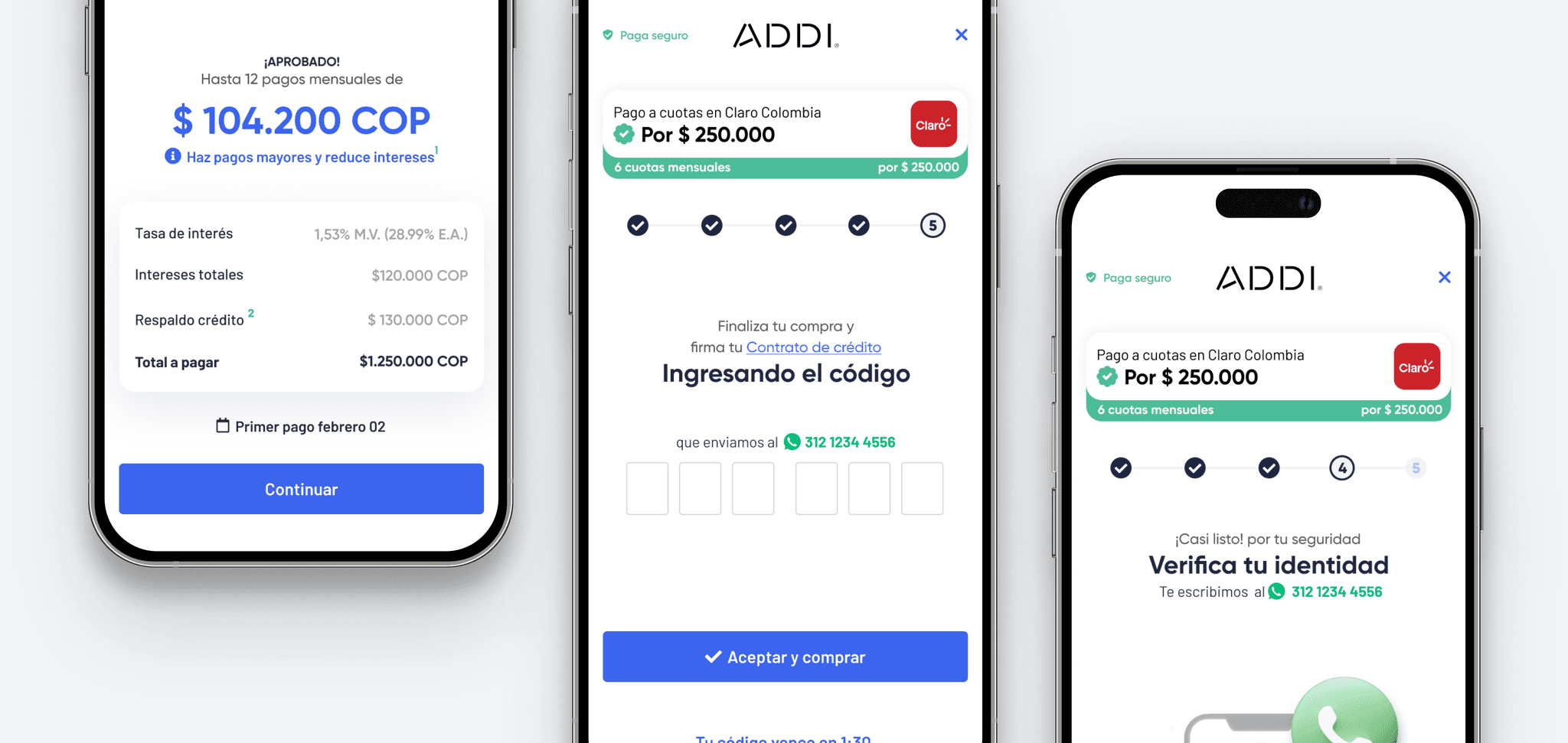

Loan acceptance

Legally, customers were required to sign a contract to accept a personal loan. We facilitated this process by providing a One-Time Password (OTP) upon successful identity verification, enabling a secure and straightforward contract acceptance.