Crypto meets instant payments

As Latin America’s leading crypto exchange, Bitso was required by Brazil’s Central Bank to participate in its instant payment system, Pix. This system allows individuals, companies, and government entities to send or receive payments within seconds, anytime—24/7, even outside regular business days.

Date

March 2022

Company

Bitso

Team

PM, EM and CD

Role

Product Designer

Platforms

Mobile and web

The problem

Discovery

The regulations outlined precise feature requirements, making it essential to strategically prioritize the roadmap and coordinate engineering efforts. To streamline this process, we began by defining the information architecture, enabling us to identify feature hierarchies early on. This approach helped prevent unnecessary dependencies and ensured smoother parallel development as we continued defining upcoming features.

Architecture information

To define a robust architecture, we conducted a benchmark analysis of both direct and indirect competitors, aiming to blend the strengths of traditional and next-generation financial products.

Following this, we held card-sorting sessions with Brazilian customers to identify where we could innovate beyond industry standards and where users expected familiar patterns. This approach allowed us to balance innovation with user expectations, creating an architecture that feels intuitive yet forward-thinking.

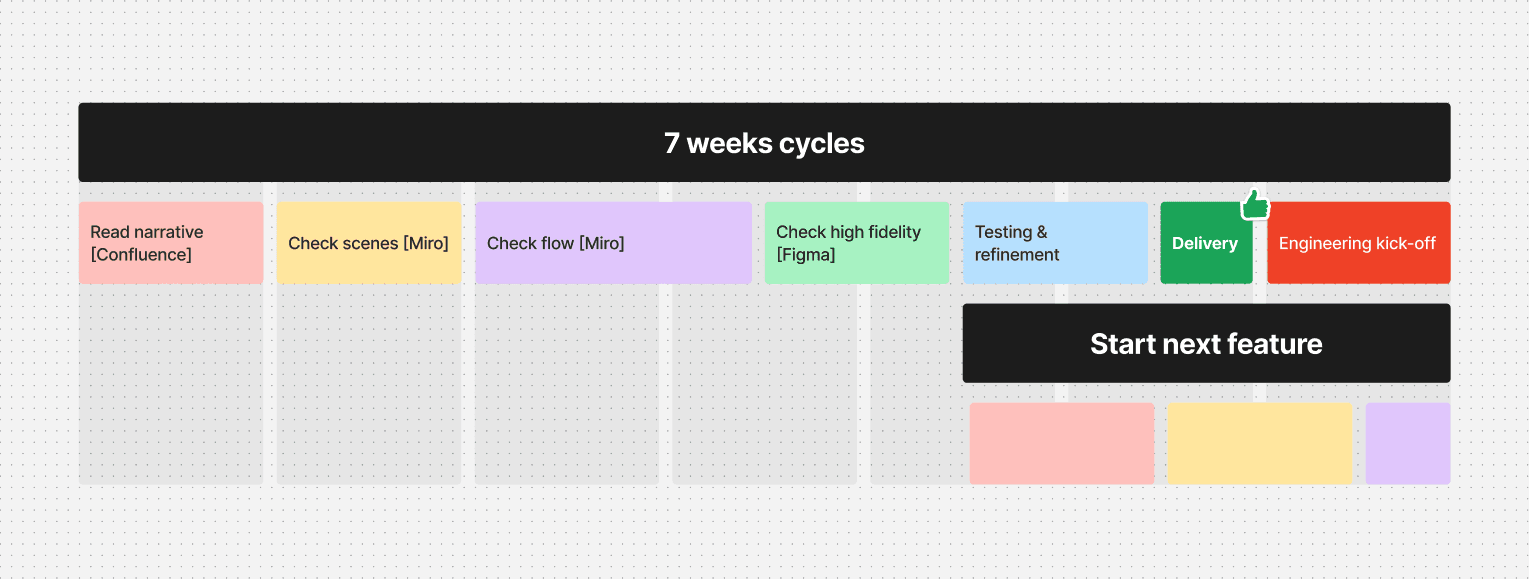

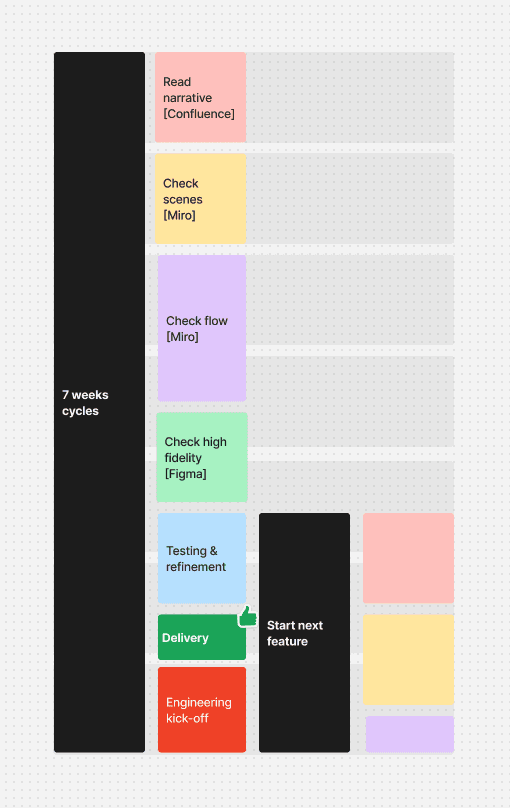

A framework

Set macro narrative

Area Pix stands as the most widely adopted digital payment product in Brazil, integrated across all banking apps. However, Bitso users engage with the platform primarily to invest in crypto, with motivations and usage contexts differing significantly ferature to feature understanding behavior for each feature was key.

Developing scenes

The macro narrative provided insight into where users are coming from and what they aim to achieve. This understanding allowed us to accurately map each scene into specific flows, which were then translated into screens.

Edge cases and pain points

The initial scene mapping provided idealized flows that didn’t fully capture customers’ realities and concerns. To address this, we incorporated a specific step in our framework to identify pain points by gathering feedback from Brazilian customers on each feature. This allowed us to allocate dedicated content spaces within the journey to address their concerns and design tailored experiences for edge cases.

Regulatory alignement

A final review with the compliance and legal teams helps reduce the risk of investing engineering resources in a feature that may not fully meet regulatory requirements.

Delivery highlights

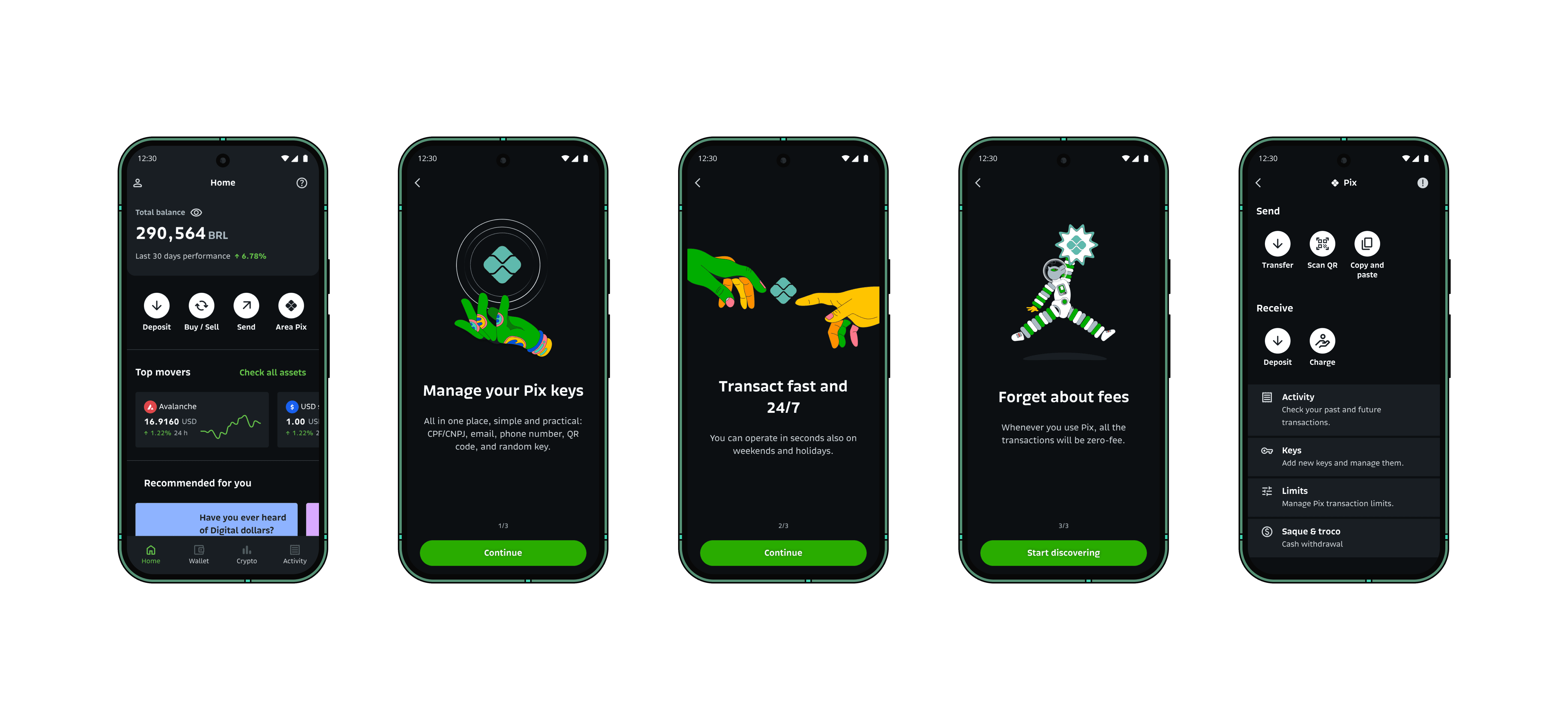

Onboarding and home screen

It encompasses all features related to Brazilian payments, functioning as a system “reset” to help customers clearly distinguish payment functions from Bitso’s broader platform features.

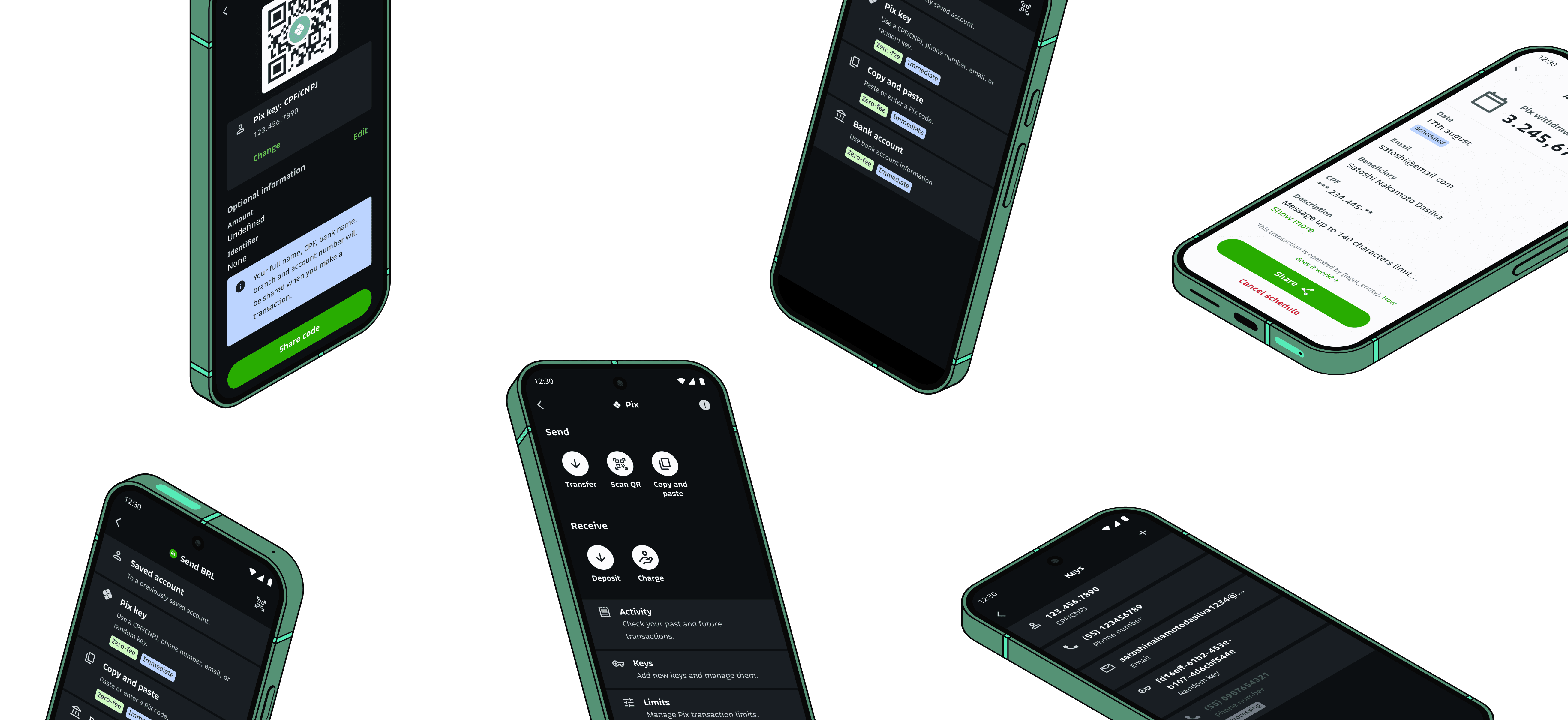

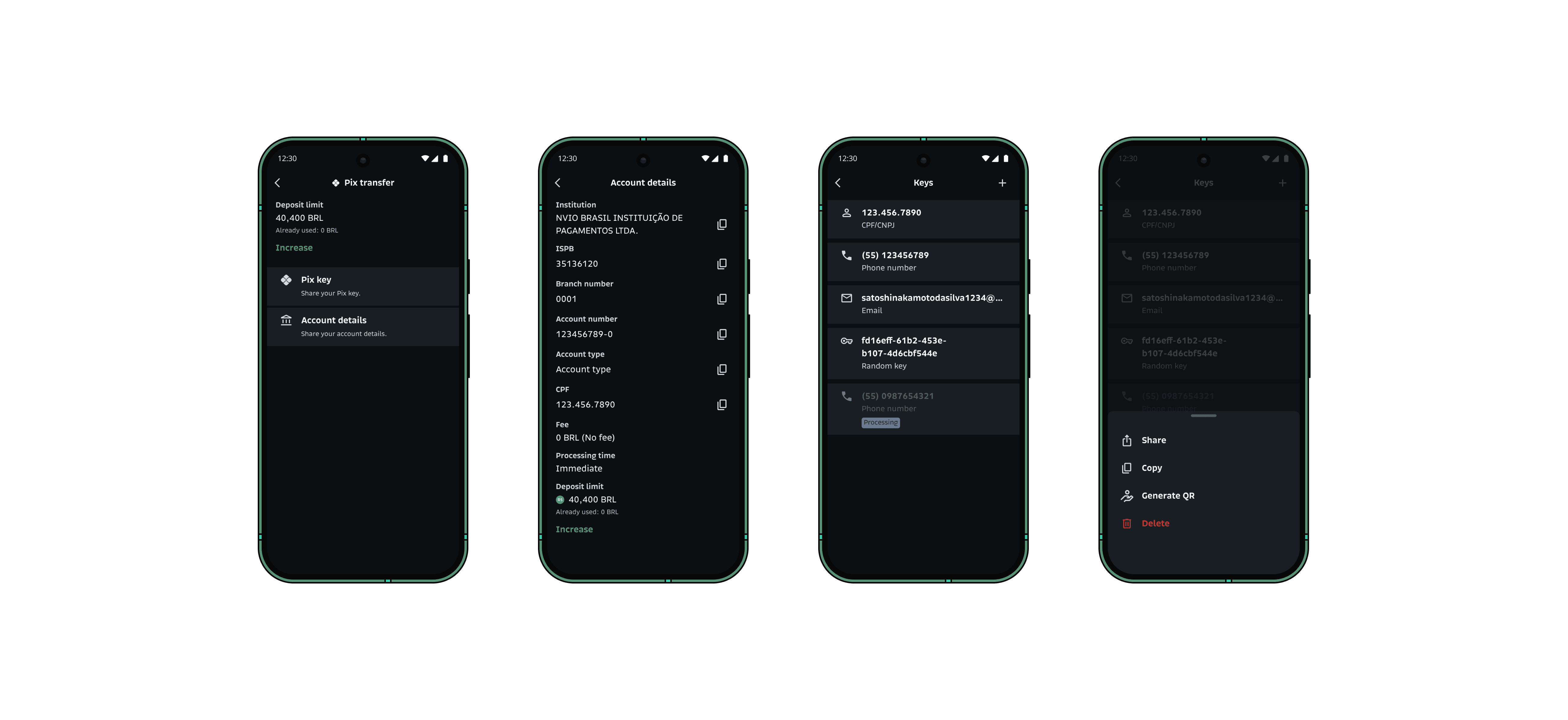

Keys management

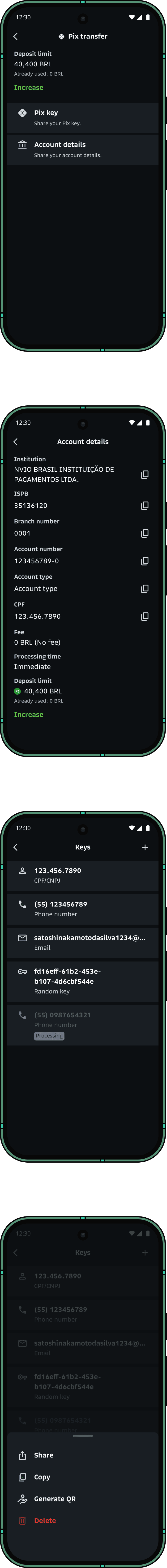

A Pix Key enables Brazilians to transfer money using just a single piece of information, which can be user-owned (such as a phone number, ID, or email address) or generated by the platform (a random key).

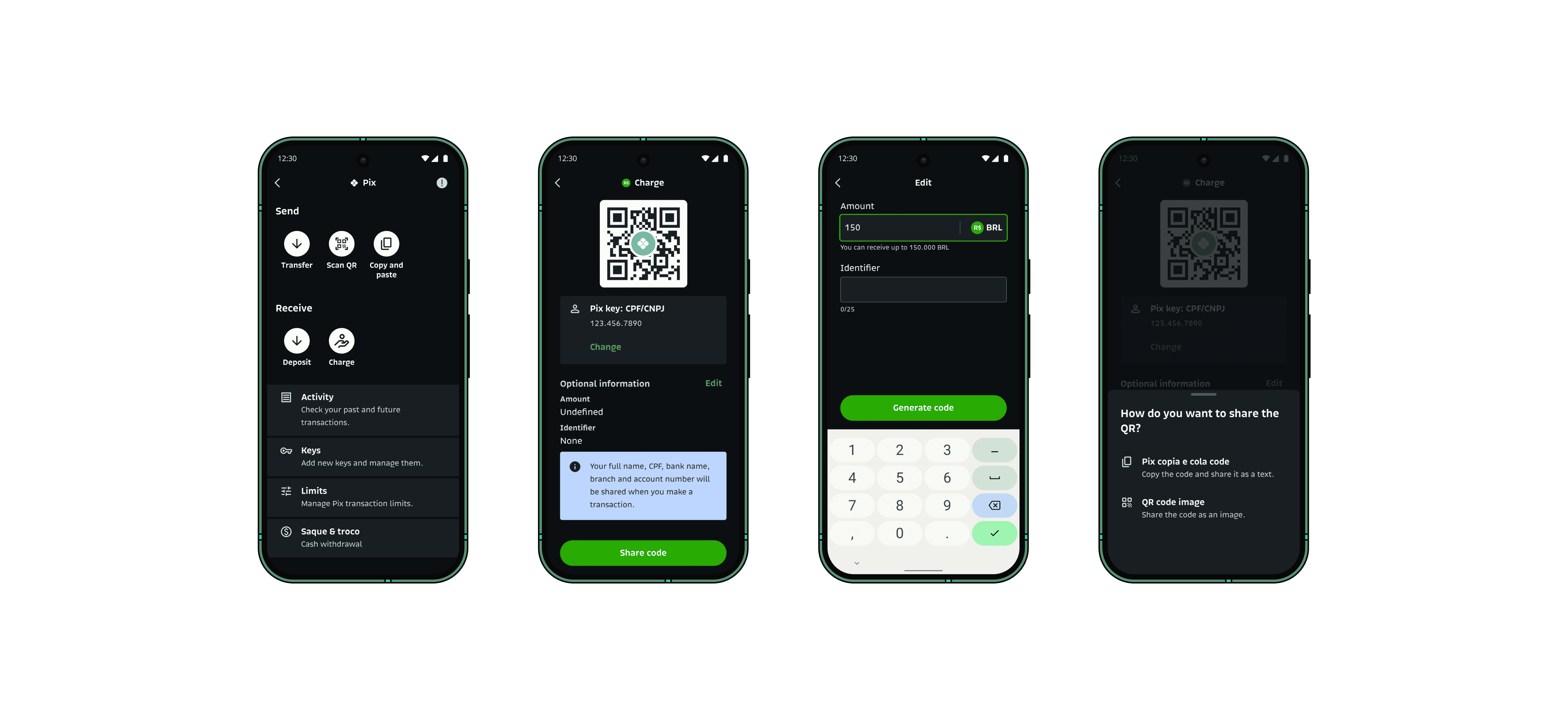

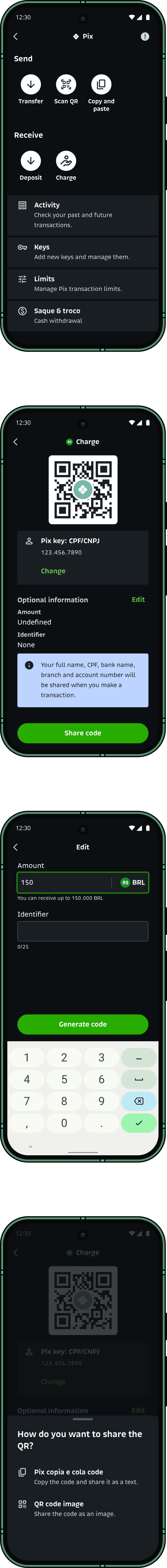

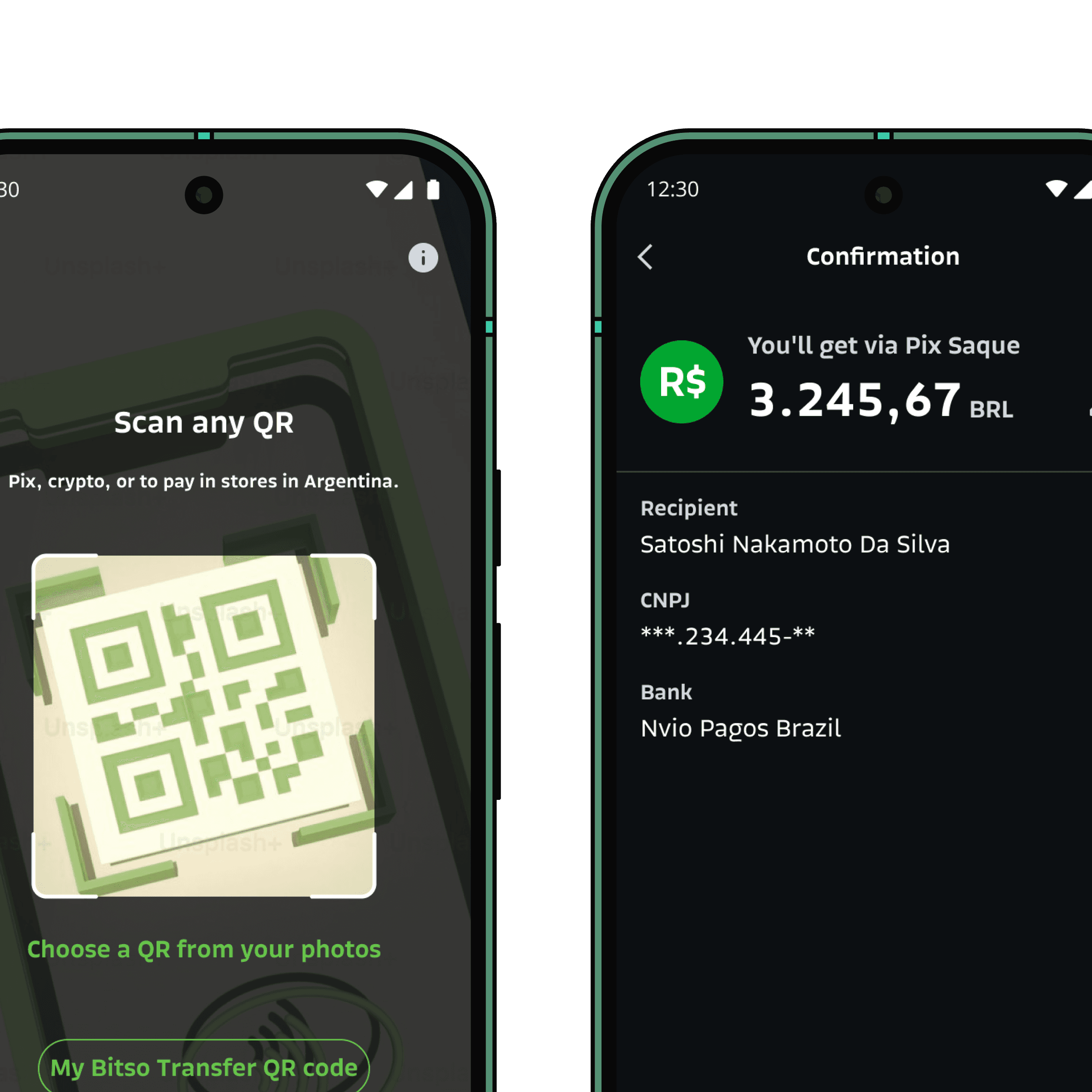

QR payments

In Brazil, 40% of in-store payments are made through QR codes. These QR codes can embed transaction value, descriptions, and essential payment details, enabling merchants and consumers to easily send and receive payments.

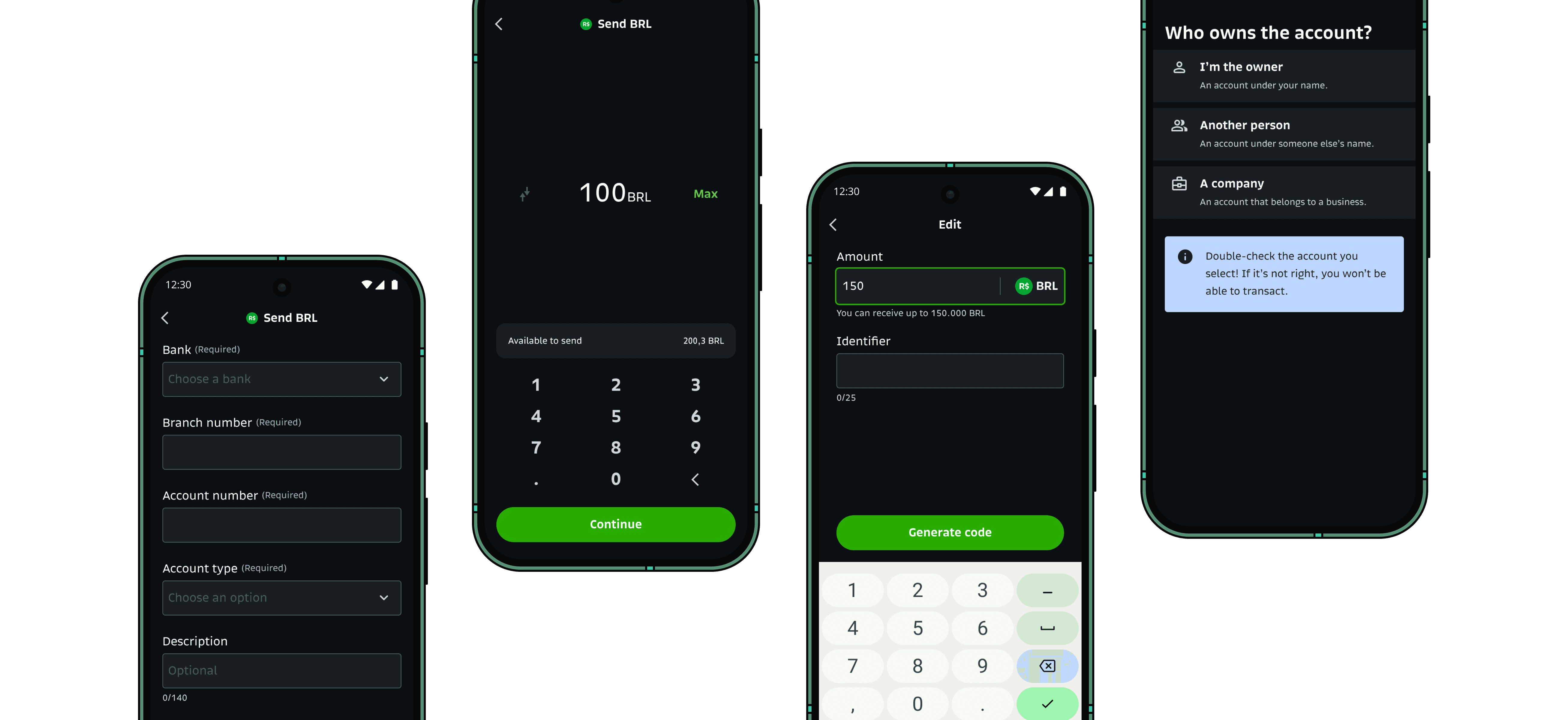

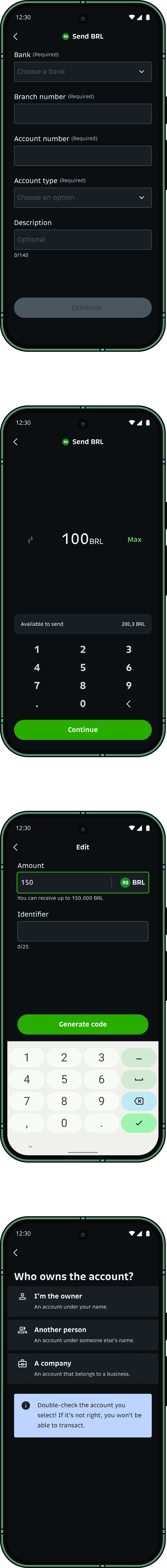

Pix transfer

Integrating Bitso’s cash-out experience with Pix was crucial to delivering a seamless and familiar user journey. Through Pix, customers could easily transfer funds using Pix keys, bank account details, or the “copia e cola” QR code string.

Schedule payments

This feature, outlined by regulation, allows customers to easily meet monthly financial obligations such as loans and pay subscriptions without needing a credit card. On this feature we take advantage of the entrypoint (Withdrawal confirmation over withdrawal flow) to enhance confirmation and receipt for all Bitso clients in all jurisdictions.

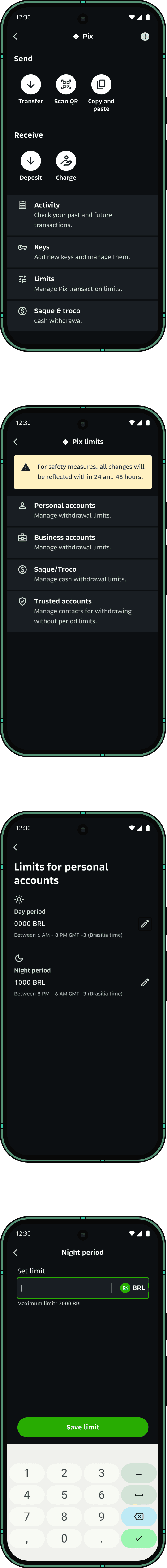

Manage limits

Given Brazil’s high rates of fraud and crime, payment systems must allow customers to set customized transaction limits by time of day, account type, and trusted accounts, providing enhanced security and control.

Cash withdrawal

Despite the impressive adoption of Pix, 30% of payments are still made in cash. To address this, regulators introduced the “Saque” and “Troco” features, enabling customers to withdraw cash using their Pix keys. Entry points were a challenge due to QR codes also are widely used in Crypto industry, so we developed an interoperable QR code scanner to read Saque and Troco QR codes no matter which place on the Bitso app customer choose to start the flow.

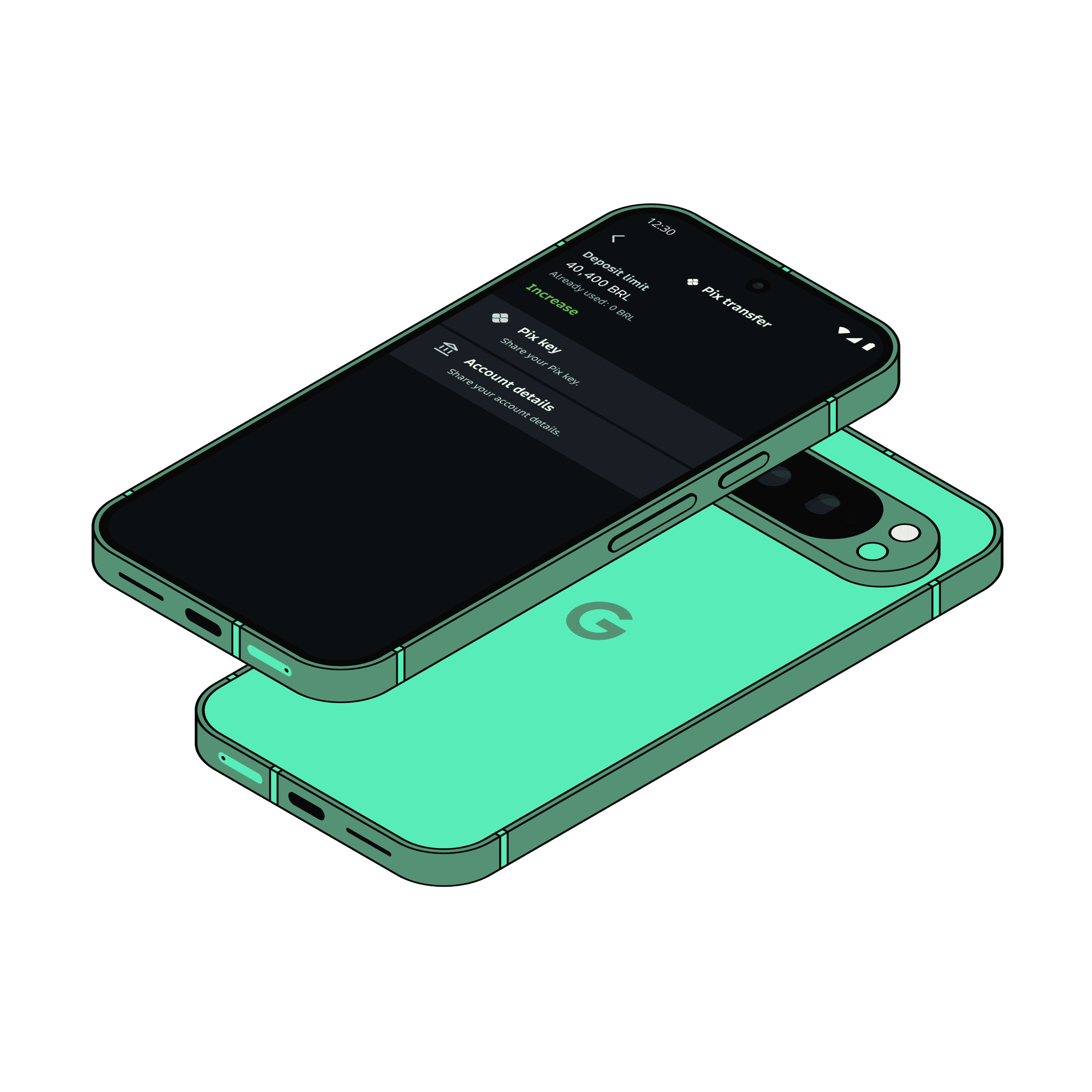

Receive a Pix transfer

Integrating Bitso’s cash-in experience with Pix was essential for providing a seamless, familiar user journey. With Pix, customers can effortlessly receive funds directly into their Bitso accounts using Pix keys or bank account details.